Buyer’s Resources

10 Steps to Buying a Home

The Services We Provide for Buyers

- Walk you through the entire home buying process from start to finish.

- Refer you to qualified lenders and guide you through the lending process.

- Set up showings for every home you want to see and accompany you to answer questions and provide support.

- Negotiate your offer.

- Help you choose a qualified home inspector and attend the inspection with you whenever possible.

- Negotiate repairs, ensuring serious problems are addressed using proper contract verbiage for your satisfaction.

- Monitor your loan commitment by regularly communicating with the lender to keep your mortgage application on track.

- Guide you through the appraisal process.

- Help you determine which home insurances are necessary and which are not.

- Attend your final walk-through to confirm agreed-upon repairs are completed.

- Review all closing statements with you before the closing date and answer any questions.

- Be there when you receive your keys!

- Serve as your realtors for life, not just for this one transaction.

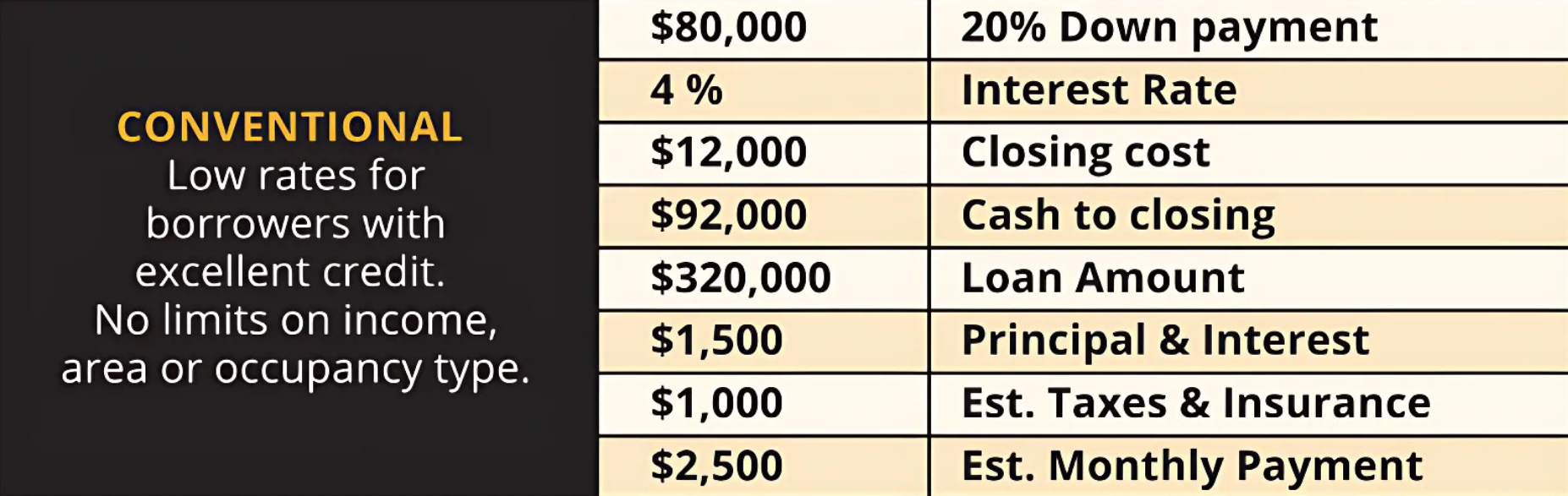

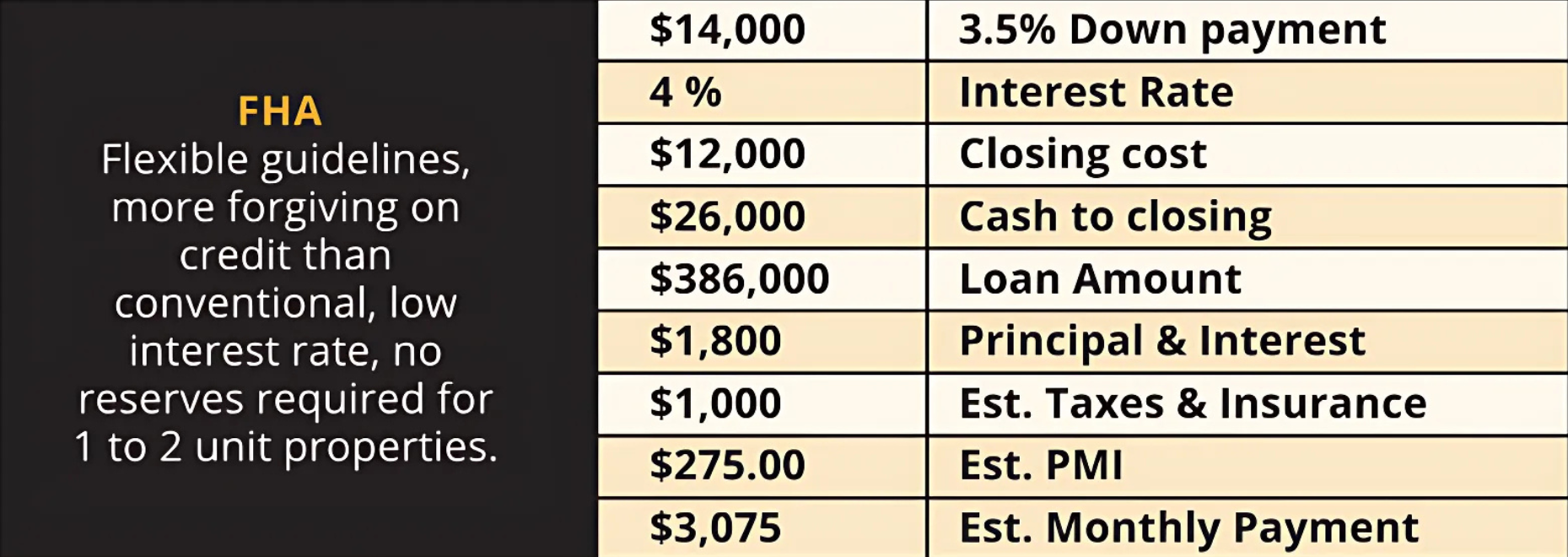

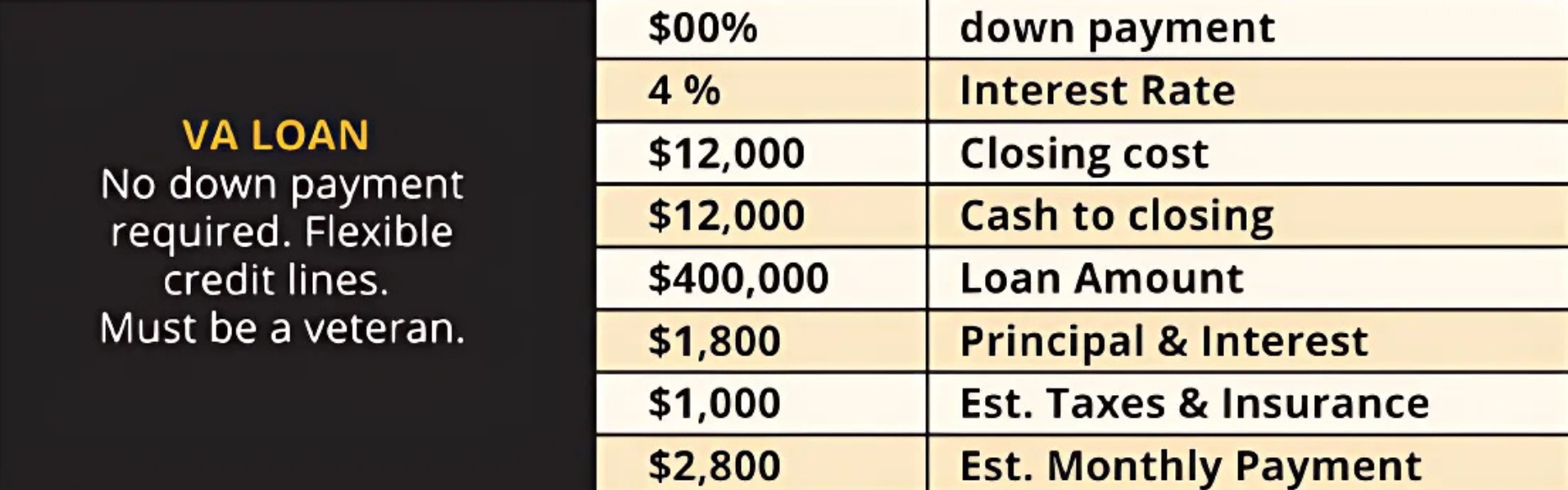

3 Common Type of Loan

Which one is Right For You?

(A $400,000 HOME LOAN – 30 YEAR FIXED RATE)

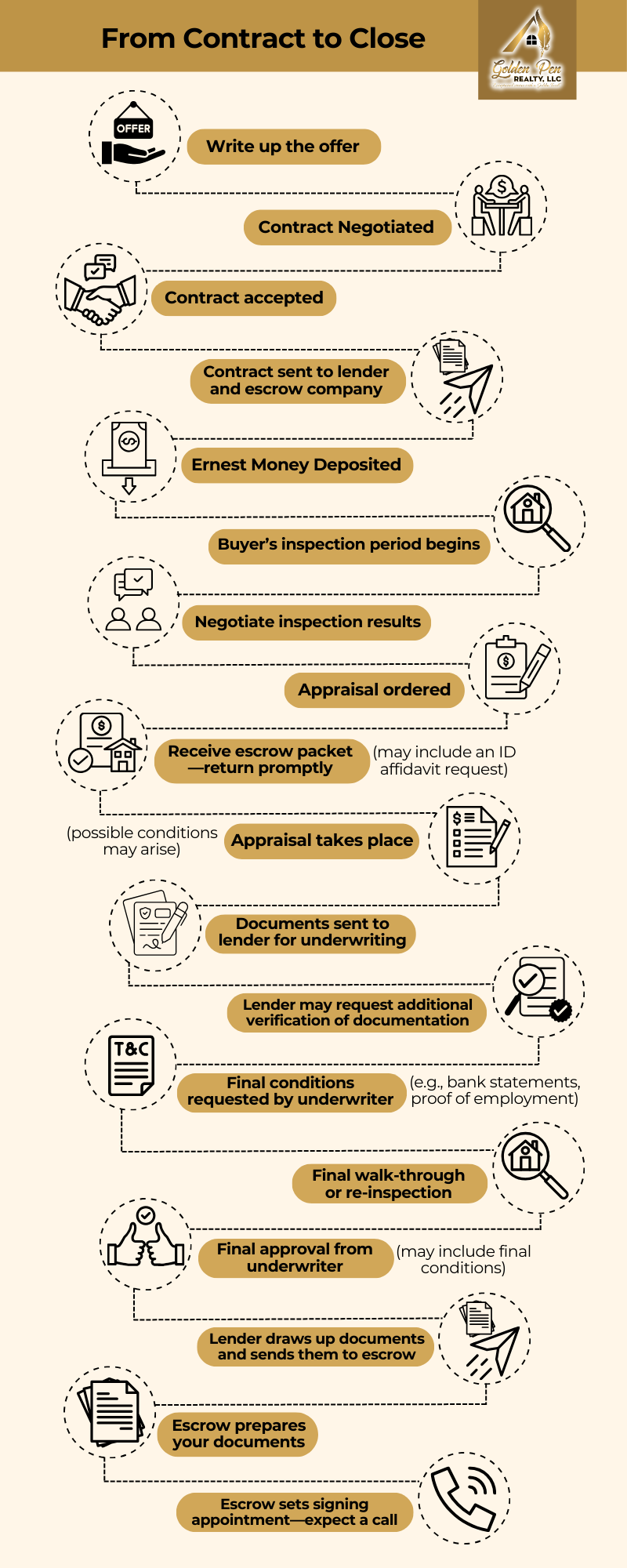

From Contract to Close

An Inforgraphic